The Ultimate Guide To Estate Planning Attorney

Table of ContentsOur Estate Planning Attorney Diaries10 Simple Techniques For Estate Planning AttorneyEstate Planning Attorney Things To Know Before You Buy7 Simple Techniques For Estate Planning AttorneyThe Basic Principles Of Estate Planning Attorney

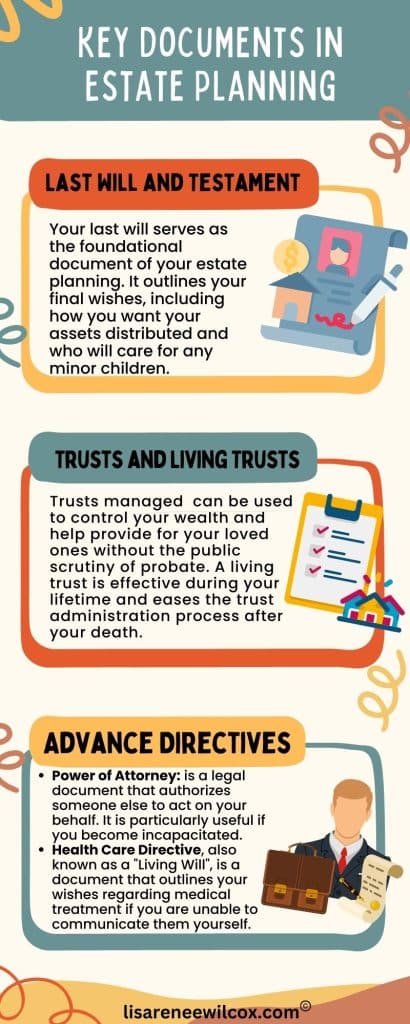

Encountering end-of-life choices and securing household wide range is a challenging experience for all. In these tough times, estate preparation attorneys help individuals plan for the distribution of their estate and develop a will, count on, and power of lawyer. Estate Planning Attorney. These lawyers, also described as estate legislation attorneys or probate attorneys are certified, seasoned professionals with an extensive understanding of the federal and state laws that put on how estates are inventoried, valued, spread, and tired after death

The intent of estate preparation is to correctly get ready for the future while you're sound and capable. A properly ready estate plan sets out your last dreams exactly as you want them, in the most tax-advantageous manner, to avoid any kind of inquiries, misconceptions, misunderstandings, or conflicts after fatality. Estate preparation is a field of expertise in the legal occupation.

The Ultimate Guide To Estate Planning Attorney

These attorneys have a thorough understanding of the state and government laws associated with wills and trusts and the probate process. The tasks and responsibilities of the estate attorney might consist of counseling clients and composing legal files for living wills, living counts on, estate plans, and estate taxes. If required, an estate planning lawyer may take part in litigation in probate court on behalf of their customers.

According to the Bureau of Labor Stats, the employment of attorneys is expected to grow 9% between 2020 and 2030. Regarding 46,000 openings for attorneys are predicted yearly, usually, over the decade. The path to ending up being an estate planning attorney resembles other technique locations. To get involved in legislation college, you have to have a bachelor's degree and a high GPA.

Ideally, think about opportunities to get real-world work experience with mentorships or teaching fellowships related to estate planning. Doing so will certainly offer you the abilities and experience to gain admission into regulation institution and connect with others. The Law Institution Admissions Test, or LSAT, is an essential part of applying to regulation college.

Typically, the LSAT is available 4 times annually. It is essential to prepare for the LSAT. A lot of possible students begin examining for the LSAT a year beforehand, commonly with a study hall or tutor. Many regulation trainees request legislation school during the loss semester of the final year of their undergraduate research studies.

Getting My Estate Planning Attorney To Work

On average, the yearly wage for an estate lawyer in the U.S. is $97,498. Estate intending attorneys can work at huge or mid-sized law firms or branch out on their own with a solo practice.

This code connects to the restrictions and regulations troubled wills, trusts, and various other lawful records relevant to estate preparation. The Uniform Probate Code can differ by state, however these regulations control various elements of estate planning and probates, such as the development of the trust or the lawful credibility of wills.

Are you unpredictable about what occupation to seek? It is a challenging question, and there is no simple response. Nonetheless, you can make some considerations to assist decide easier. Sit down and detail the points you are good at. What are your staminas? What do you take pleasure in doing? As soon as you have a list, you can limit your options.

It includes visit this site choosing exactly how your belongings will be distributed and who will certainly manage your experiences visit this website if you can no more do so on your own. Estate planning is a required part of financial preparation and ought to be made with the assistance of a certified professional. There are numerous aspects to think about when estate preparation, including your age, health, financial scenario, and family circumstance.

The smart Trick of Estate Planning Attorney That Nobody is Talking About

If you are young and have couple of belongings, you might not need to do much estate planning. If you are older and have extra valuables, you must consider distributing your possessions amongst your heirs. Wellness: It is an important variable to think about when estate planning. If you remain in health, you might not need to do much estate preparation.

If you are wed, you must consider exactly how your possessions will be distributed in between your partner and your beneficiaries. It aims to make sure that your assets are distributed the way you desire them to be after you die. It consists of considering any kind of taxes that might need to be paid on your estate.

A Biased View of Estate Planning Attorney

The attorney additionally aids the people and families develop a will. The attorney additionally helps the individuals and family members with their depends on.